- info@rgblogix.com.com

- +92-324-454-9683

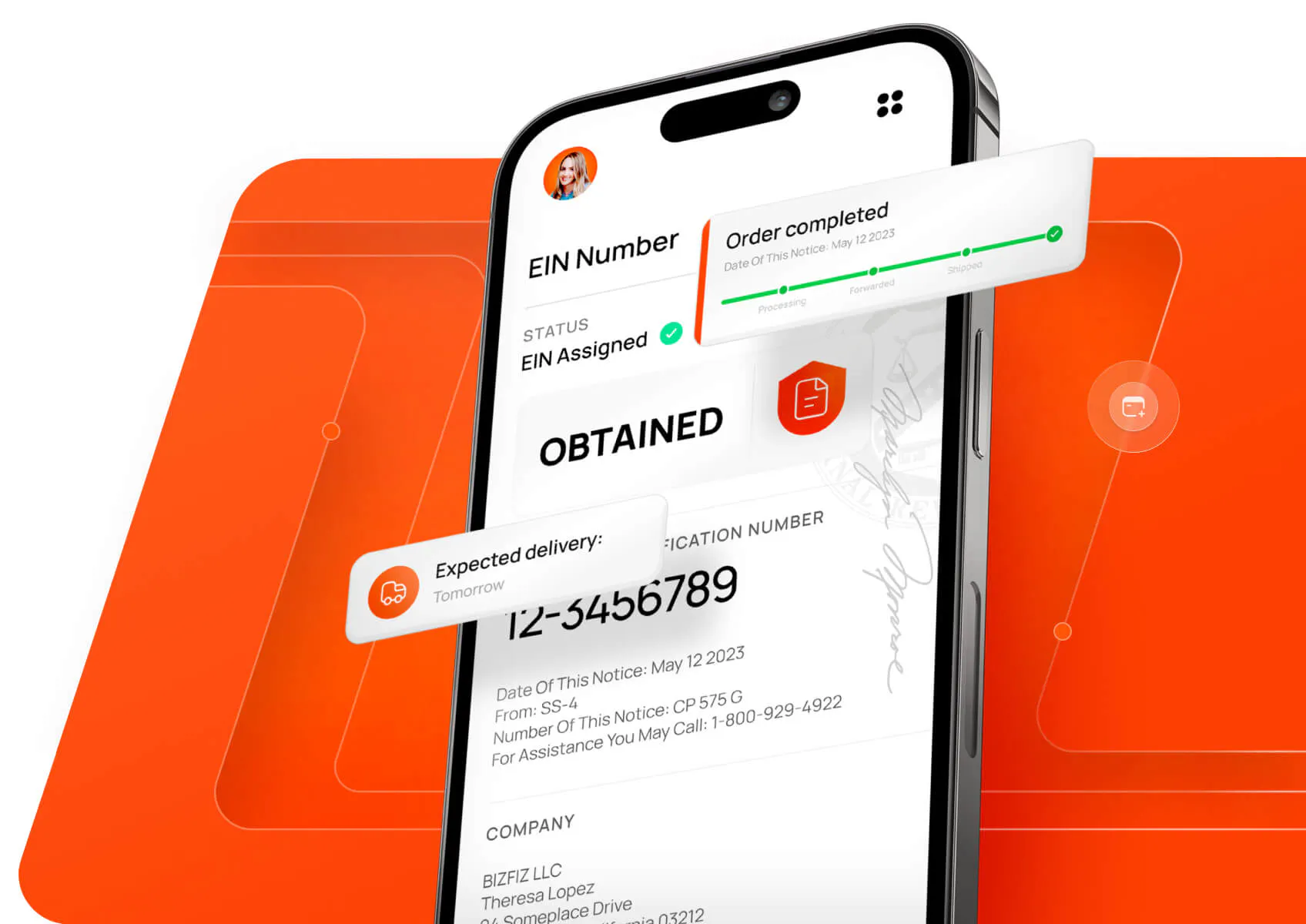

EIN (Employer Identification Number)

An EIN is an exclusive nine-digit number assigned to your business by the Internal Revenue Service and identifies your business for tax purposes. It’s like your Social Security Number, except it’s designed for businesses only. It’s necessary for paying employees and managing your business taxes. EINs are issued by the state and used on state tax forms.

An Employer Identification Number (EIN) is mandatory for some businesses and optional for others. But in general, an EIN is necessary for independent contractors and small business owners. Understanding who needs to apply and the benefits that come with having an EIN can give your business a real advantage.

The following business structures are required to have EINs

Corporations

Partnership

LLC

Why Choose US?

Obtain your Employer Identification Number (EIN) with RGB LOGIX.

Our streamlined process ensures a hassle-free experience, allowing you to secure your EIN efficiently and providing expert guidance and timely support.

Let’s simplify your journey to business success

Your Security And Privacy Protection Is At The Heart Of Everything We Do

Ready To Get Your EIN?

Frequently Asked Questions

We gather here all the questions you needed

Oftentimes no, because it could create confusion.

But if the other mark is used for different products or services, it might be possible because consumers may not be confused about who sells what.

Yes. The USPTO allows one trademark—that’s one name, one logo, or one slogan—per trademark application.

You can register a logo that includes your business name, but then the design and the text together are considered one trademark. If you want them protected individually, you’ll need to file two applications as you compete the trademark registration process.

Non-US citizens without a taxpayer ID, such as an SSN or ITIN, cannot apply for an EIN using the IRS’s online form. Instead, they will need to apply for an EIN from the IRS by mail or fax (form SS-4) or telephone. Applying for an EIN by telephone is an exclusive method for international applicants. If filing by phone, it’s a good idea to fill out the SS-4 form before calling to ensure you have all the required information ready.

RGB LOGIX

RGB LOGIX is working under the company of ARIVOT LLC. We are an e-commerce business dedicated to bringing quality and convenient products and services right to your doorstep!

ARIVOT LLC hopes to be the place you always use when you shop online.

Providing e-simple way to shop any product or services.

Office Locations

Balcones Dr. STE 17888, Austin, TX 78731, USA

Victoria Road, London, W8 5RF, United Kingdom

Shop No. 8 England Cluster International City Dubai, UAE

Office # 1, 7th Mezzanine Floor, 16 Chohan Tower Shadman II Jail Road, Lahore, 54000, Pakistan